How The Agentic SaaS Movement Unlocks a $6T Opportunity

Disclaimer: I am not a financial analyst or investment advisor. I am a software engineer and SaaS consultant with 5+ years of experience in CRM platforms, data engineering, and AI automation. The financial data cited in this report is sourced from public market data and third-party research. This is not investment advice.

The age of the builder is here.

But does that mean SaaS is dead?

No. Far from it.

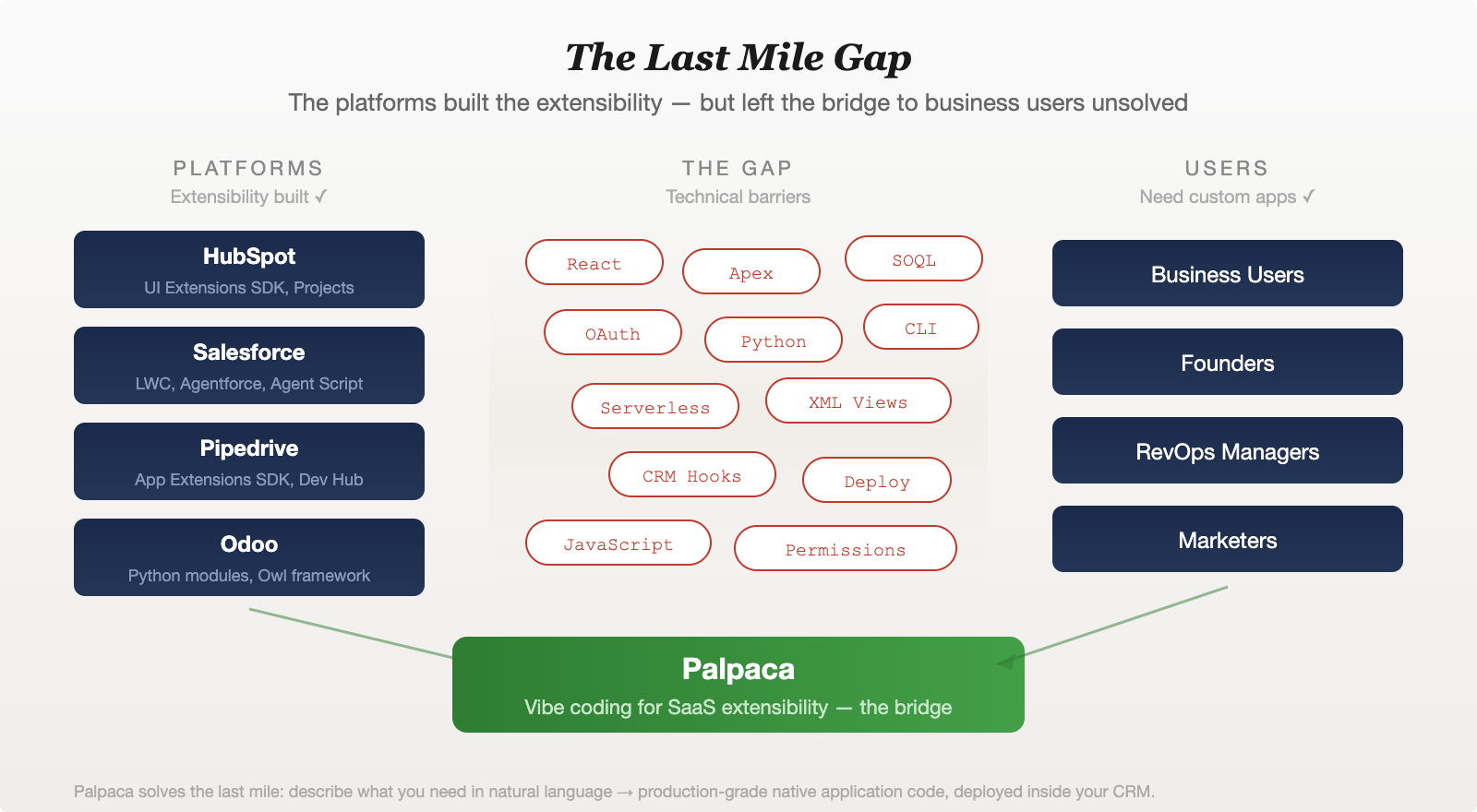

Forward-looking SaaS providers like HubSpot, Salesforce, Pipedrive, and Odoo have been investing in platform extensibility for years — quietly building the code-first deployment platforms that make agentic software possible.

These aren’t reactions to the SaaSpocalypse. They are years-long, deliberate bets that the future of SaaS isn’t a closed product, but an open operating system for business.

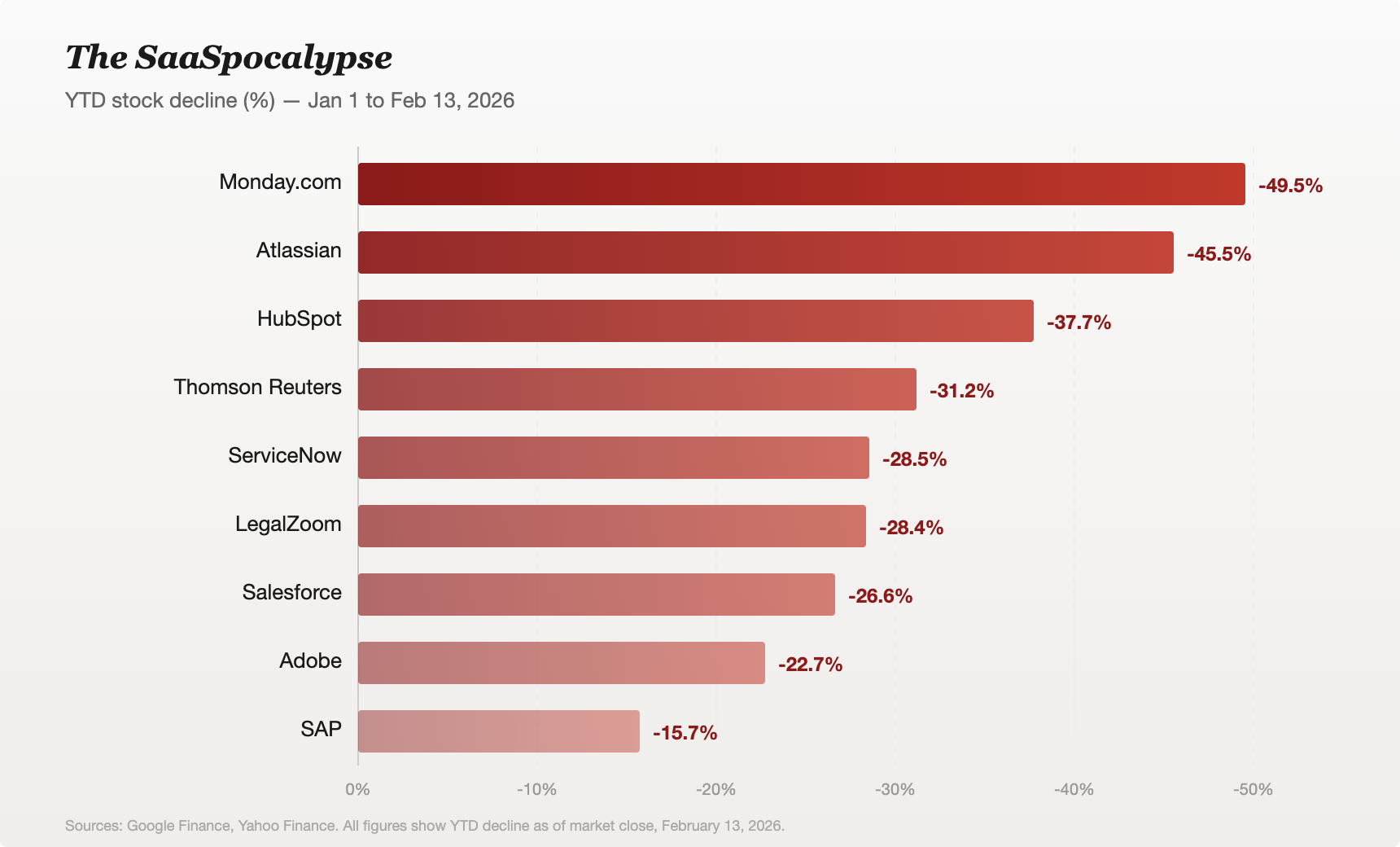

And yet, in the span of 48 hours in early February 2026, nearly $300 billion in market value evaporated from the software sector [1].

Within weeks, that number climbed past $1 trillion [2].

Wall Street declared it the SaaSpocalypse — the death of SaaS as we know it.

I believe the opposite is true.

The SaaSpocalypse — What Actually Happened

The roots stretch back to mid-2024, when Salesforce experienced its worst trading day in two decades — a 20% single-day drop [3]. But the real panic came on January 30, 2026, when Anthropic released 11 open-source plugins for Claude Cowork [4] — spanning productivity, sales, finance, legal, marketing, customer support, and more [5].

Jefferies equity trader Jeffrey Favuzza called it “an apocalypse for software-as-a-service stocks” — coining the term SaaSpocalypse [6].

- Thomson Reuters dropped 16%.

- LegalZoom fell 20%.

- Salesforce, ServiceNow, and Adobe each dropped ~7%.

- SAP fell 33% from yearly highs [7].

- HubSpot declined ~70% over twelve months [8].

The iShares Tech-Software ETF entered a technical bear market [9].

JP Morgan titled their note “Software Collapse Broadens with Nowhere to Hide” [10].

Hedge funds made $24 billion shorting the sector [11].

The narrative: AI agents can now do what SaaS products do. Why pay $200/seat/month for software an AI can replace? I believe that narrative is fundamentally wrong.

What Wall Street Got Wrong

A CRM is not a user interface.

It is a deeply interconnected system of data models, permission structures, workflow automations, integrations, audit trails, and compliance frameworks — built on years of institutional knowledge. You don’t replace that by generating a React app in 30 seconds.

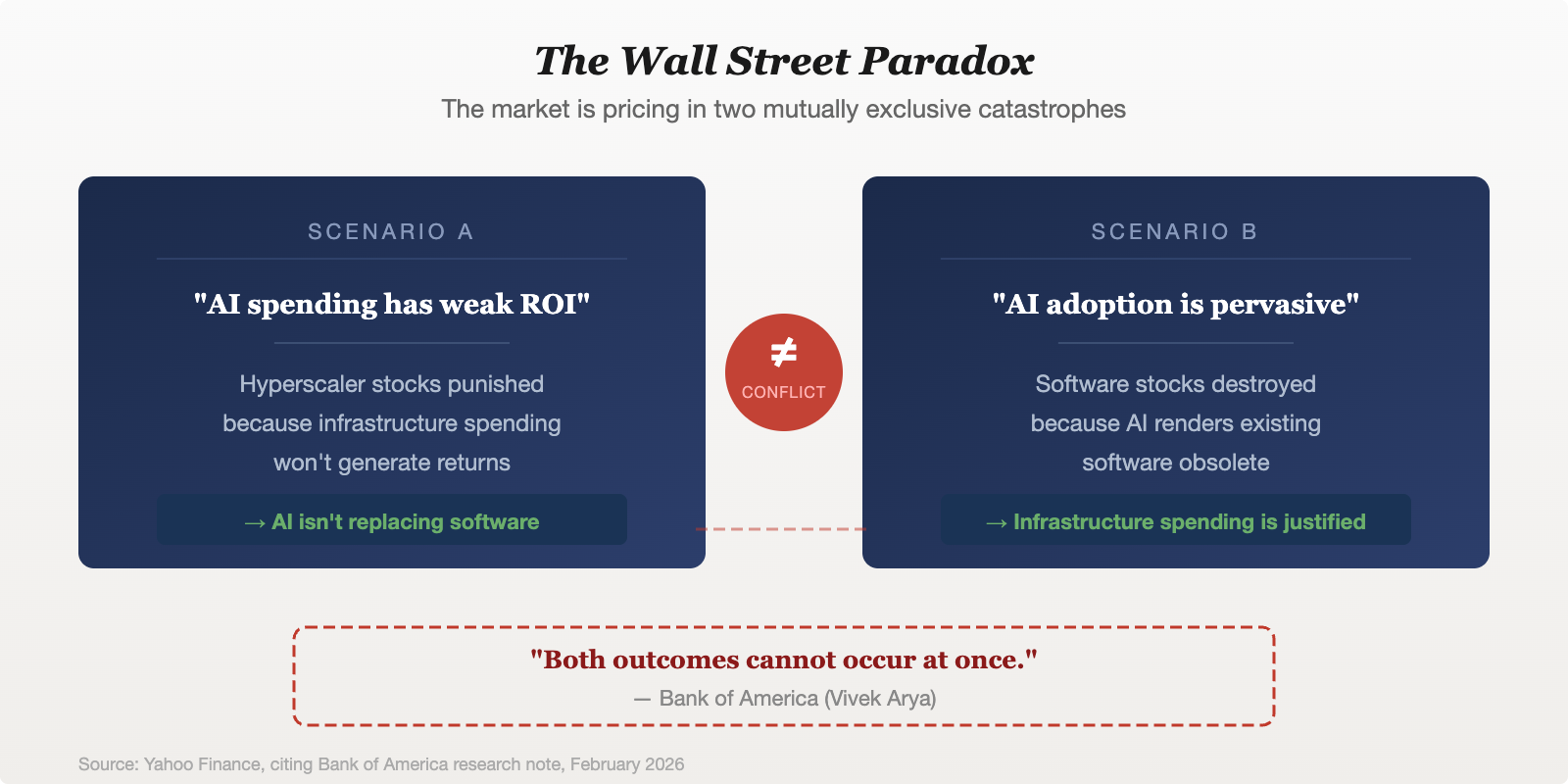

Bank of America’s Vivek Arya identified the paradox: investors are simultaneously punishing hyperscaler stocks because AI spending might not generate returns, while destroying software stocks because AI will render all software obsolete. Both cannot be true [12].

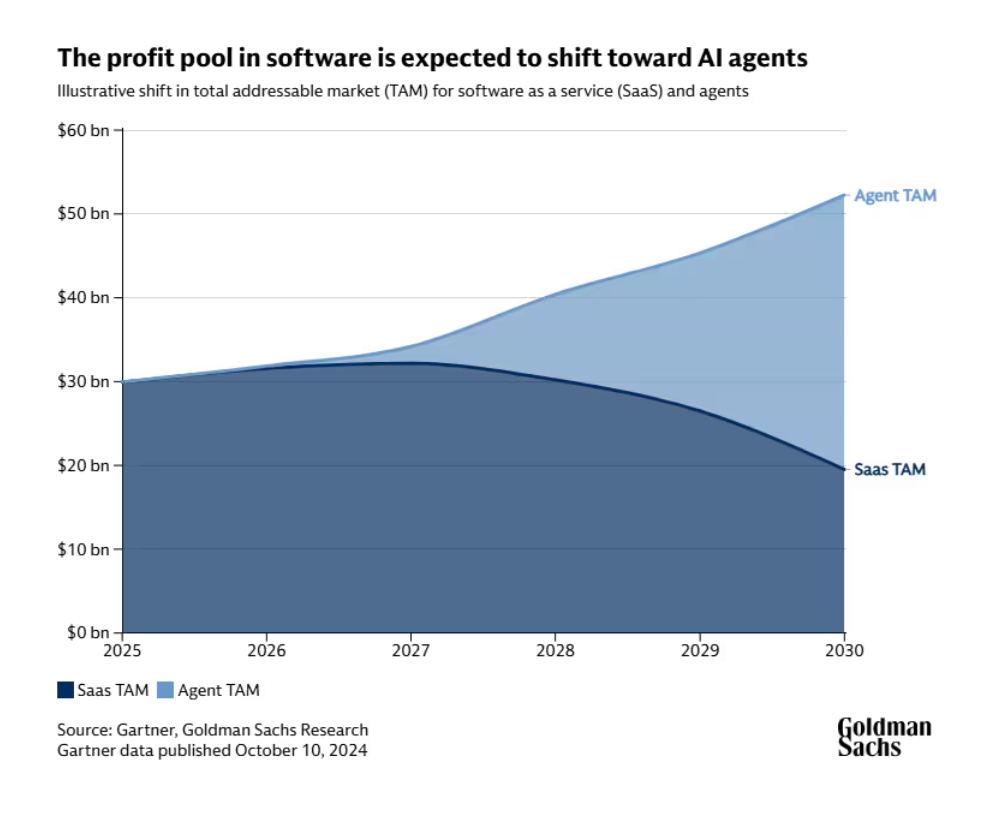

Goldman Sachs projects the application software market growing to $780 billion by 2030 — a 13% CAGR [13]. By then, AI agents are expected to account for more than 60% of total software economics [14]. The profit pool shifts from SaaS seats to agentic workloads — but the entire market gets larger, not smaller.

Goldman also projects the total cloud market reaching $2 trillion by 2030, with SaaS contributing $780 billion [15].

But the most provocative case comes from a16z’s Alex Rampell: if AI enables software to actually complete work, the addressable market isn’t the ~$350 billion in enterprise software spend — it’s the multi-trillion-dollar white-collar services market [16].

Analysts estimate this opportunity at approximately $6 trillion [17].

The SaaSpocalypse wiped $1 trillion based on the fear that AI kills SaaS. The data suggests AI embedded in SaaS platforms could unlock a market 17x larger than what exists today.

The Platforms Were Already Ready

While investors panicked, the platforms themselves had already built the infrastructure for AI-native development — not outside their ecosystems, but inside them.

| Platform | Extensibility Framework | Key Capabilities |

|---|---|---|

| HubSpot | UI Extensions SDK + Projects framework | React-based apps running natively in the CRM, serverless functions, CRM data hooks, single CLI deployment |

| Salesforce | Lightning Web Components + Agentforce | LWC since 2019; Spring ‘26 added Agentforce DX MCP Server, Agentforce Vibes IDE, and Agent Script [18] |

| Pipedrive | App Extensions SDK + Developer Hub | JSON panels, custom modals, JavaScript SDK with auth, theming, and data exchange |

| Odoo | Modular Python architecture + Owl framework | Open-source, full module extensibility through custom Python modules and Owl frontend |

These are not experimental features.

They are core strategic bets backed by years of engineering and billions in R&D.

They all point in the same direction: SaaS platforms are evolving from closed products into open operating systems for business.

The infrastructure is ready. What’s been missing is the bridge — the tool that makes this extensibility accessible to everyone, not just developers who can navigate an SDK.

That bridge is what I call the Agentic SaaS Movement.

Enter the Agentic SaaS Movement

Vibe coding — coined by Andrej Karpathy in February 2025 [19] — lets you describe what you want and AI generates the code. Platforms like Lovable, Bolt, and Replit leaned into this. CNBC reporters recreated Monday.com’s core features using Claude Code in under an hour for less than $15 [20]. Monday.com’s stock declined over 50% YTD [21].

But building a beautiful front-end that looks like a CRM is not the same as building a CRM. A generated app has no customers, no pipeline data, no workflow automations, no integrations.

It is a shell — impressive to look at, useless to operate.

The real power of vibe coding isn’t in replacing SaaS platforms — it’s in extending them.

This is the core thesis of the Agentic SaaS Movement: AI-powered code generation combined with platform extensibility lets anyone build real, production-grade applications that run inside their CRM — personalized to their data, schema, workflows, and business logic.

Custom dashboards, client portals, approval workflows, niche integrations — applications that were too niche for vendors and too expensive for custom development are now viable.

The Agentic SaaS Movement doesn’t shrink the SaaS market. It expands it dramatically.

Palpaca: The First Platform for the Agentic SaaS Movement

The extensibility exists — but the barrier to entry is too high.

Building a custom HubSpot app requires React, platform-specific components, serverless architecture, CRM hooks, and deployment pipelines.

The same goes for Salesforce (Apex, SOQL, DX toolchain), Pipedrive (JavaScript, OAuth), and Odoo (Python, XML views). Each platform built the infrastructure but left the last mile unsolved.

Palpaca solves the last mile.

You describe what you need in natural language.

Palpaca generates production-grade, native application code — purpose-built for the target platform’s SDK, component library, and deployment framework.

It’s personalized to your schema, your CRM data, and your external credentials. The code is yours — native, self-contained, and independent of Palpaca to keep running.

Today, we’re starting with HubSpot.

Tomorrow, every forward-looking SaaS platform becomes a target.

What Comes Next

The SaaSpocalypse was built on a fear — that AI makes SaaS obsolete.

The Agentic SaaS Movement is built on a fact — that AI makes SaaS indispensable.

When every business can build custom applications inside the platforms they already depend on, those platforms evolve from software you use into infrastructure you build on.

This is the trajectory Goldman Sachs projects [13], what a16z’s Rampell describes [16], and what Bank of America was pointing at when they called the sell-off “internally inconsistent” [12].

Every element is in place: the infrastructure, the AI capability, the market pressure, the business demand. What was missing was someone willing to put these pieces together and ship it.

That’s what Palpaca is.

To every SaaS provider reading this: your platform is more valuable than your stock price suggests. The extensibility you built isn’t a feature. It’s your future. Lean into it.

To every investor reading this: the $1 trillion that was wiped from SaaS isn’t gone. It was repriced on a flawed thesis. The companies that embrace the Agentic SaaS Movement will not only recover that value — they will create multiples of it.

To every business reading this: you no longer have to choose between expensive custom development and rigid off-the-shelf software. The era of building exactly what you need, inside the platform you already trust, has arrived.

The SaaSpocalypse called it the end of SaaS.

I call it the beginning.

Arrigo Lupori | Founder of Palpaca | arrigo@palpaca.dev | palpaca.dev

Sources

[1] MarketMinute — “The SaaSpocalypse Arrives” (Feb 12, 2026)

[2] MarketMinute — “Software-mageddon: The $1 Trillion Vaporization of SaaS” (Feb 13, 2026)

[3] CNBC — Salesforce worst trading day in two decades (May 2024)

[4] TechCrunch — Anthropic brings agentic plugins to Cowork (Jan 30, 2026)

[5] Reworked — Anthropic adds plugins to Claude Cowork

[6] Yahoo Finance — Traders dump software stocks

[7] Yahoo Finance / Benzinga / Medium — Individual stock drops

[8] Investing.com — HubSpot ~70% decline

[9] MarketMinute — iShares Tech-Software ETF bear market

[10] Philipp Dubach — The SaaSpocalypse Paradox (JP Morgan note)

[11] Philipp Dubach — Hedge funds $24B in shorts (S3 Partners data)

[12] Yahoo Finance — BofA’s Vivek Arya on mutually exclusive scenarios

[13] Goldman Sachs — AI agents to boost software market to $780B by 2030

[14] Goldman Sachs — AI agents >60% of software economics by 2030

[15] Goldman Sachs — Cloud market reaching $2T by 2030

[16] a16z — Alex Rampell: AI turns capital to labor

[17] Philipp Dubach — $6T white-collar services market estimate

[18] Salesforce Developer Blog — Spring ‘26 Release

[19] Andrej Karpathy — Coining “vibe coding” (Feb 2025)

Download the Full Report

Get the complete long-form version of this report as a PDF.